Under the Microscope: Uncovering what’s behind medical credit card no-interest financing.

Are you familiar with this medical credit card financing promo?

“No interest if paid in full within the 6, 12, 18 or 24 months promotional period.”

Medical credit card deferred interest financing may be inherently bad for patients not financially equipped to pay their entire balance within a defined promotional period. These are shared concerns across the industry and are currently being examined. It’s time for every dental practice to ask, “is medical credit card deferred interest financing the best experience for patients and the reputation of my practice?”

Before you offer medical credit card deferred interest promotions again, we want to give you a simple understanding of what your patients potentially face.

1. Deferred interest does NOT necessarily mean NO interest.

A patient will have to pay interest on deferred interest financing if they don’t pay off their entire balance by the end of the promotional period. This interest accrues from the original date of purchase and is added to the balance.

Here is the definition of deferred interest according to CareCredit:

Deferred-interest financing means you won’t pay any interest if you pay your promotional balance in full by the end of the agreed-to promotional period.

Interest still accrues from the date of purchase, though, so if you don’t pay off the balance in full by the end of the promotional period, that accrued interest will be assessed and added to your balance. Depending on your purchase cost, that could mean shelling out an additional significant cost. Deferred-interest financing may also be advertised as “No Interest if Paid within X Months.1“

2. Balloon interest, and interest on interest.

According to the National Consumer Law Center, deferred interest promotions can land consumers in a bad situation where they are responsible for a lump sum of interest at the expiration of the promotional period. If the consumer takes longer to pay off the remaining balance, including the interest, they begin accruing interest back on interest.

For consumers hit with deferred interest, those charges come in one big lump sum at the expiration of the promotional period. Interest charges that might have been manageable in small pieces can result in the outstanding balance on a card increasing dramatically. Consumers who cannot pay off that huge interest charge at once then start paying interest on the back interest.2

3. Monthly minimum payments often won’t cover the amount financed.

The minimum monthly payment is typically up to 3% of the outstanding balance. A cardholder can pay the minimum each month and be on good terms within a deferred interest promotional period, but according to the Consumer Financial Protection Bureau “…minimum payments probably won’t be enough to pay off the entire balance by the end of the deferred interest period.3” This can land patients in a situation where they made all their payments on time but still owe deferred interest because their monthly minimum payment was not enough to pay off the entire balance during the promotional period.

4. Beware of late fees.

Looking beyond interest owed, many medical credit cards come with additional costs including late fees as high as $414.

Alternatives to deferred interest promotions:

Now that you’re more savvy about deferred interest medical credit card promotions, you may be asking yourself what no interest options are available for your patients.

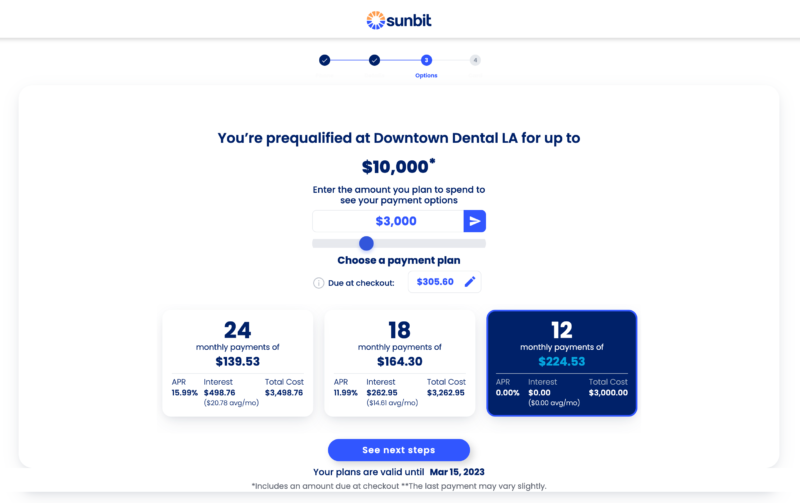

Sunbit offers access to true 0% interest options that are not promotional as well as interest-bearing plans. Powered by Sunbit technology, dental practices can offer true, no-interest programs that will never accrue interest, or charge late fees, minimum interest charges, or penalties. Also, 85% of patients who apply are approved. Payment plans with interest are fixed and do not compound. Sunbit makes it easy and transparent for you and your patients to understand exactly how much interest they’ll pay, if any at all, with no additional fees or penalties.

Sources:

- https://www.carecredit.com/well-u/financial-health/understanding-promotional-financing/

- https://www.nclc.org/resources/deceptive-bargain-the-hidden-time-bomb-of-deferred-interest-credit-cards

- https://www.consumerfinance.gov/ask-cfpb/i-got-a-credit-card-promising-no-interest-for-a-purchase-if-i-pay-in-full-within-12-months-how-does-this-work-en-40/

- https://www.carecredit.com/YourTerms/

- https://www.carecredit.com/well-u/financial-health/understanding-promotional-financing/

Subject to approval based on creditworthiness. 0% APR plans for well-qualified customers are available at participating merchants only. 0-35.99% APR. Payment due at checkout. Not available in VT, WV, or WY. Account openings and payment activity are reported to a major credit bureau. See Rates and Terms for loan requirements and state restrictions. Sunbit Now, LLC is licensed under the CT Laws Relating to Small Loans (lic. # SLC-1760582 & SLC-BCH-1844702); NMLS ID 1760582. Loans are made by Transportation Alliance Bank, Inc., dba TAB Bank, which determines qualifications for and terms of credit.